Choosing the right payment methods for your Shopify business is a critical factor that influences whether your customer will complete the purchase. A report by Dynamic Yield found that the global cart abandonment rate is around 76%, largely due to unexpected fees and a lengthy checkout.

If you focus on adopting diverse payment methods, you’re much more likely to reduce friction during checkout. For example, the Boston Consulting Group found that offering accelerated payment methods, like Shop Pay, can increase conversion rates by 50%.

Shopify offers a built-in solution called Shopify Payments, with lower transaction fees and integrated checkout. However, alternative gateways are also available. Continue reading to explore the best Shopify payment methods and find which ones are best for your business.

Getting started with Shopify Payments

Shopify Payments is a payment gateway that’s fully integrated into Shopify, letting you accept payments directly from your store. It accepts credit cards, debit cards, digital wallets like Shop Pay, and other local payment methods.

Using Shopify Payments is worth it profit-wise because you get to save money on additional fees. Here are the transaction fees with Shopify Payments and third-party providers on different Shopify plans:

| Shopify Payments | Third-party providers | |

| Basic | 2.9% + 30¢ USD | 2.9% + 30¢ USD + 2% third-party provider fee |

| Grow | 2.7% + 30¢ USD | 2.7% + 30¢ USD + 1% third-party provider fee |

| Advanced | 2.5% + 30¢ USD | 2.5% + 30¢ USD + 0.6% third-party provider fee |

With Shopify Payments, you only have to pay Shopify transaction fees, which range from 2.5%-29% + 30¢ USD. Meanwhile, using third-party payment providers requires paying additional fees of up to 2%.

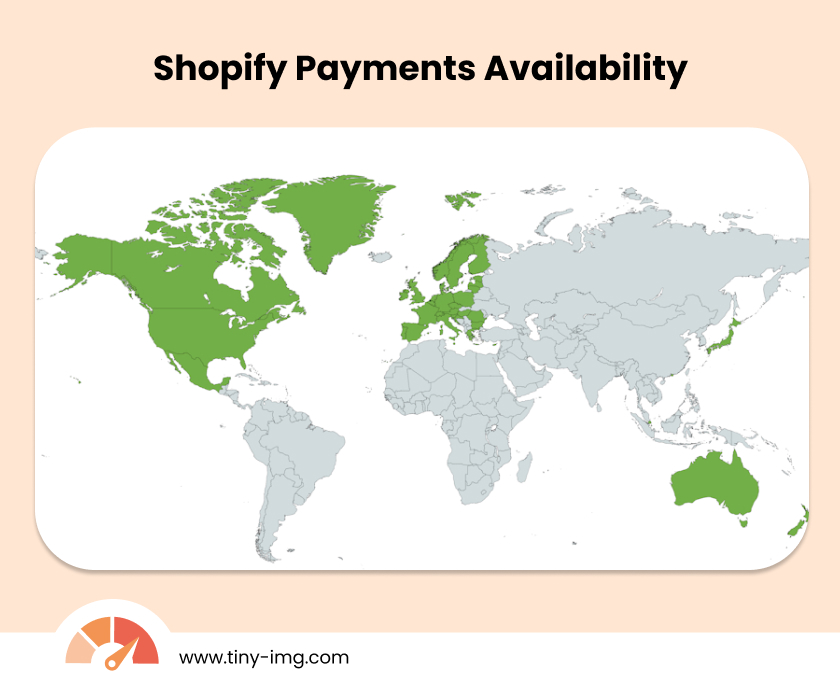

Availability

Shopify Payments isn’t available in every location in the world. Here’s where the platform is supported:

Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hong Kong, Hungary, Ireland, Italy, Japan, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Singapore, Slovenia, Spain, Sweden, Switzerland, United Kingdom, United States.

If you’re based in a country where Shopify Payments isn’t available, your only option is to use third-party payment providers.

Why use Shopify Payments?

Shopify Payments comes with multiple benefits that don’t necessarily come with third-party gateways. Here’s why Shopify Payments is useful:

- Integrated checkout – your customers don’t need to go through third-party payment processors to complete a purchase.

- Simple setup – Shopify Payments is easy to set up, as all you need to do is complete your account setup with relevant details, including banking details and business information.

- Lower transaction fees – you save money when handling payments with Shopify Payments because you don’t need to pay up to 2% transaction fees for third-party providers.

- Security – Shopify adheres to Level 1 PCI DSS standard compliance, which guarantees that the tool meets the highest security standards. Plus, it comes with a fraud analysis feature and Dynamic 3DS, which requires customers to authenticate their purchase within their bank for extra security.

How to set it up?

Setting up Shopify Payments requires checking if your store is eligible to use it. Other than that, the setup process is simple. Here’s a simple guide on how to do it:

- Review eligibility. Review if your store falls into Shopify Payments’ eligibility requirements based on your country. Then, ensure you’ve set the correct currency (the same one as your product prices) in Shopify Settings > General.

- Enable Shopify Payments. Head to Shopify Settings > Payments and activate Shopify Payments by completing the account setup.

- Insert your company information. When you activate Shopify Payments, you can proceed with filling out your business details and personal information. This includes your business type, number, Employee Identification Number (EIN), and more.

- Test if Shopify Payments works. You can test if the provider works by going to Shopify Settings > Payments and clicking “Manage” under the Shopify Payments section. Click “Enable test mode” and press “Save.” If you’re from France, use the Bogus Gateway for testing.

Alternative payment gateways to consider

Whether Shopify Payments isn’t supported in your location or you want specific local payment methods, there are plenty of alternatives to Shopify Payments. However, note that you can only select one primary gateway to operate on your store at once.

Here’s a quick overview of the most popular third-party payment gateways on Shopify:

PayPal

PayPal is one of the most widely known payment gateways that comes with fraud prevention, instant fund access, and global compliance. It also lets you automatically offer Venmo at Shopify checkout.

The only downside is that PayPal comes with higher transaction fees, which differ based on the transaction method. For example, PayPal Checkout and Venmo take 3.49% + a fixed fee, while standard credit card payments take 2.99% + a fixed fee.

| Best for | Companies that prioritize customer trust |

| PayPal Checkout transaction fees | 3.49% + fixed fee |

| Credit and debit card transaction fees | 2.99% + fixed fee |

| PCI DSS compliance | Yes |

| POS system integration | Yes |

Stripe

Stripe is another popular payment gateway that allows accepting credit card and mobile payments. It offers features for international marketplaces and invoicing. It’s a good option for businesses that are selling subscriptions due to recurring payment features.

Stripe online transaction fees are set to 2.9% + 30¢, but for in-person selling, it’s 2.7% + 5¢. For in-person selling, there’s also a 1.5% fee for international cards and a 10¢ fee for contactless payment.

| Best for | Companies that sell subscriptions |

| Online transaction fees | 2.9% + 30¢ |

| In-person transaction fees | 2.7% + 5¢ (+1.5% for international cards and + 10¢ for contactless payment) |

| PCI DSS compliance | Yes |

| POS system integration | Yes |

Adyen

Adyen supports over 100 payment methods on Shopify and processes international payments, making it a great option for international stores. However, its pricing structure is quite complicated. The Adyen base processing fee is 13¢, and there are also specific payment method fees applied.

| Best for | International selling |

| Online transaction fees | 13¢ + payment method fee |

| PCI DSS compliance | Yes |

| POS system integration | Yes |

Authorize.net

Authorize.net is a payment gateway provider that comes with advanced fraud protection features, 3D Secure checkout, and recurring payments. It’s owned by Visa and is priced on the premium side.

With Authorize.net, you’ll have to pay a monthly $25 subscription fee, not just transaction fees. For example, if you’re using the payment gateway and the merchant account, you’ll pay 2.9% + 30¢ for credit card payments.

| Best for | Stores that prioritize security |

| Transaction fees (gateway + merchant account) | 2.9% + 30¢ |

| Transaction fees (gateway only) | 10¢ per transaction + 10¢ daily batch fee |

| PCI DSS compliance | Yes |

| POS system integration | Yes |

Modern payment options that can boost sales

Choosing payment methods that your target audience prefers can be a game-changer for your Shopify conversion rates. Let’s review the modern payment options that you can implement to drive more sales.

1. Digital wallets (Apple Pay, Google Pay)

Digital wallets, like Shop Pay, Apple Pay, or Google Pay, are a popular payment method because they provide a seamless user experience. Customers can complete purchases with a single tap or face scan, which makes purchasing fast.

You can enable digital wallets through the payment gateway you use. For example, if you have Shopify Payments enabled, all you have to do is:

- Head to Shopify Settings > Payments > Shopify Payments > Manage.

- Check the digital wallet you want to use.

2. Buy Now, Pay Later (Klarna, Afterpay)

Buy Now, Pay Later (BNPL) offers consumers the opportunity to buy an item but pay for it in interest-free installments. This method is not as popular globally, with the share of eCommerce and POS transaction value being just 5% and 1% respectively, based on the Worldpay report.

However, the situation is different in the US. In a survey conducted by Numerator, 48% of Americans said they consider the BNPL payment method for purchases that exceed $200.

If you want to set up BNPL on Shopify, you first have to find a provider that is supported in your location. Here are some options:

| Shop Pay | US, UK, Canada |

| Klarna | Austria, Croatia, Cyprus, Estonia, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Slovenia, Spain, Sweden, UK |

| Afterpay | Australia, Canada, New Zealand, UK, and US |

| Price | Free |

Then, all it takes is finding your chosen provider in Shopify Payments and checking it.

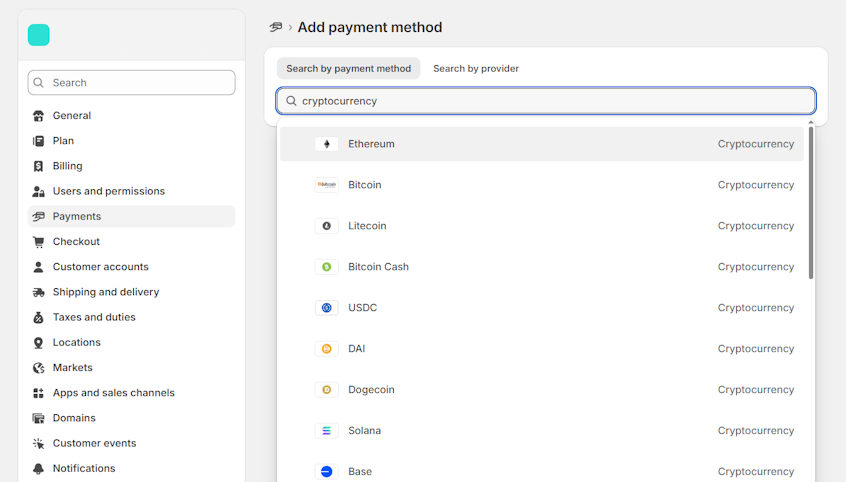

3. Cryptocurrency payments (Bitcoin, Ethereum)

Cryptocurrency payments are growing in popularity, but they’re more widely used among tech-savvy shoppers. At the moment, Shopify supports crypto payments through third-party gateways. Here’s how you can set it up:

- Head to Shopify Admin > Settings > Payments.

- Under “Additional payment methods” section, click Add payment methods.

- Insert “cryptocurrency” in the search bar and locate the cryptocurrency you’re interested in.

4. QR code

QR code payments are better for in-person selling, such as local deliveries or pop-ups. The way it works is you generate a QR code that links to the checkout page or specific product. After customers scan the code, they can use their preferred payment method.

You can create QR payments by getting Shopify’s own Shopcodes app or picking a third-party app. It lets you create codes that link to checkout, making selling on Shopify quick and simple.

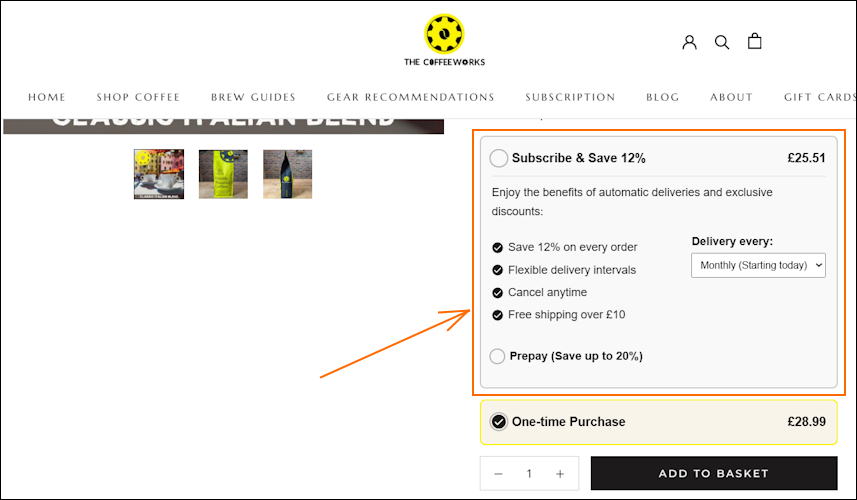

5. Subscription billing

If you’re offering products that customers buy regularly, like supplements or coffee, you can set up subscription billing. It helps foster customer loyalty and grow revenue with repeat purchases. Here’s an example of how it can look on a product page:

For subscriptions, Shopify offers a first-party Shopify Subscriptions app. Alternatively, there are third-party options that are feature-rich, such as Appstle or Recharge.

Payment preferences around the world

Digital wallets appear to be one of the most popular payment methods in many Western countries. According to a report by Worldpay, digital wallets made up 53% of global eCommerce and 32% of POS transaction value in 2024. You can explore the full Wordplay findings on the different payment method global share in the table below:

| eCommerce | POS | |

| Digital wallets | 53% | 32% |

| A2A | 7% | 4% |

| BNPL | 5% | 1% |

| Credit cards | 20% | 25% |

| Debit and prepaid | 12% | 22% |

| Cash | 2% | 15% |

The table reveals that merchants should focus on providing a seamless user experience with digital wallets but not forget traditional payment methods like credit cards.

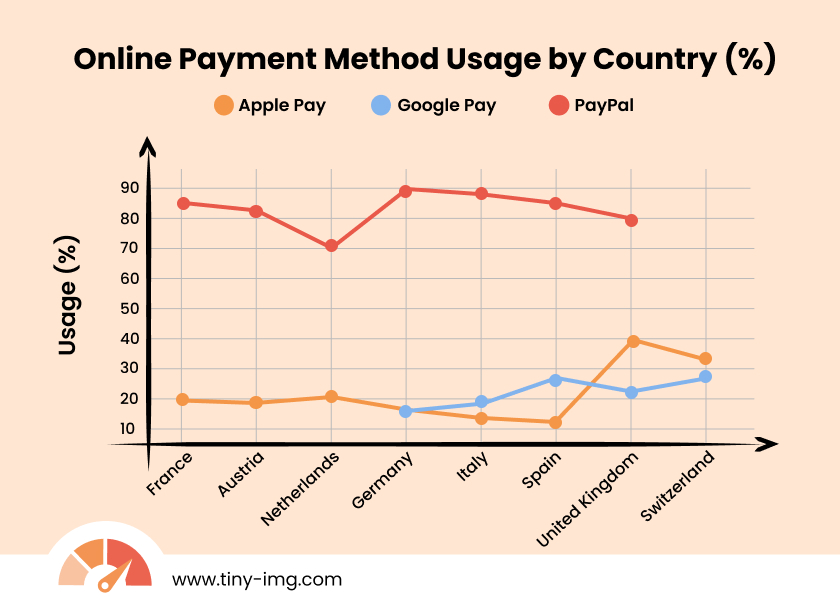

You should also consider the country you’re selling in, as the specific payment method usage depends on the region. For example, Statista data on Apple Pay, Google Pay, and PayPal usage showed that Apple Pay dominates in the UK, while PayPal is more prominent in France.

Meanwhile, the global market share for BNPL in 2024 was 5%. However, according to BNPL Global Market Insights, 24% of eCommerce payments in Sweden used BNPL in 2022, followed by 23% in Germany.

As for cryptocurrency payments, they aren’t as popular as other payment methods but still make a percent of market share in some regions. According to Statista, cryptocurrency makes up 3.1% of the total market share in Slovenia and 2.6% in Luxembourg.

The best payment methods to adopt depend on your business. Consider which methods are most popular in your region, but also take into account what would work best for your business. For example, if a large part of your site traffic comes from mobile devices, consider using digital wallets.

Making your checkout experience seamless

Making your checkout flow smooth is exceptionally important for Shopify store conversions. Even if your products are top-quality, an inconvenient checkout can show poor sales results. Here are a few tips on how to make your checkout experience seamless:

- Reduce friction. Shopify supports many payment methods, so make sure you offer methods that your target audience finds convenient and prefers best. For example, a study by Stripe found that businesses that offered Apple Pay saw an average 22.3% conversion rate increase.

- Set up express checkout. Implement Shop Pay, Google Pay, or Apple Pay, which cut checkout time by allowing customers to skip entering billing information. A case study by PayPal revealed that using accelerated guest checkout returned an 86% conversion rate compared to around 74% for non-accelerated checkout.

- Optimize mobile checkout. According to Statista, 60% of eCommerce sales were made on mobile devices in 2023, and the number is expected to grow. So, review the checkout journey on your mobile site and optimize it for user experience. This includes ensuring input fields are big enough for fingers on a small screen and checkout buttons are placed above the fold.

- Run A/B tests. Use A/B testing apps like Optimizely to find what works best for your store. Create two versions of your checkout page with different button placements or payment methods, split traffic between them, and track performance.

- Address security concerns. Display trust markers on your checkout page so customers are sure their payments are secure. This can be Shopify’s SSL badge, payment method logos, or badges like “powered by Stripe.”

Conclusion

Considering the easy integration and lower transaction fees, Shopify Payments is an ideal choice for many Shopify merchants. It also supports a wide range of payment methods, including the popular digital wallets and Buy Now, Pay Later options, giving you loads of flexibility.

However, it’s important to consider what’s best for your business and target audience. Run A/B tests, learn how you can reduce friction during checkout, and optimize the user experience for mobile users. Finding the right payment method combinations will help lead your Shopify stores to success faster.

Frequently asked questions

Shopify takes $3.20 off of a $100 sale if you’re using Shopify Payments, which is a $2.90 transaction fee + $0.30 fixed fee. For merchants who are using third-party payment gateways, there’s an additional 2% transaction fee, which results in $5.20 off of a $100 sale in total.

You can collect payments on Shopify by using Shopify Payments or a third-party payment provider. These tools allow your site visitors to make payments at checkout. You can set up payment methods by going to your Shopify Admin > Settings > Payments.

Shopify Payments comes with high chargeback fees, which can be around $15 USD, depending on the country. Plus, the platform isn’t available in many countries, so merchants from many Asian or African countries will have to choose third-party providers.

Shopify Payments is the best payment provider you can use on the platform because it offers simple integration and setup and helps you save on transaction fees. With third-party providers, you’d have to pay the Shopify transaction fee on top of the third-party processor’s fees, while Shopify Payments only requires paying the standard credit card processing fee.