Trump’s tariffs are introducing new challenges for Shopify businesses that rely on international suppliers, but they also present opportunities to strategically adapt and gain a competitive edge.

For some businesses, the tariffs on China and other important trading partners have caused a decline in profit margins. However, with a strategic approach, businesses can successfully adapt to these changes and stay competitive.

With years of experience in eCommerce and a deep understanding of dropshipping businesses, we’ll break down methods to minimize tariff effects on your Shopify business.

Overview

- As of April 9, Trump has declared a trade war by imposing 10% tariffs on all countries. Dozens of top global US partners face even higher tariffs.

- Trump’s new tariffs will affect all Shopify businesses that get their supplies or products from abroad.

- Currently, Canadian and Mexican goods that are unapproved by the US-Mexico-Canada Agreement (USMCA) face a 25% tariff, while compliant goods have a 0% tariff.

- Trump has also announced 25% tariffs on steel and aluminium from the European Union (EU). As of April 9, all other EU goods will face a 20% tariff too.

- Trump’s tariffs will likely increase product and shipping costs, but Shopify owners can overcome it by switching to domestic suppliers.

- To minimize tariff impact, businesses should also diversify suppliers in countries with lower tariff rates and optimize their pricing strategy.

- It’s important to avoid placing the full tariff price increase on customers and rather negotiate better product rates and shipping.

Countries affected by Trump tariffs

The White House issued a statement on February 1, 2025, that Donald Trump is implementing import tariffs on Canada, EU, Mexico, and China. However, the situation keeps changing by the day.

April update: As of April 9, the following tariffs will apply for the top US trading partners according to the White House’s latest statement:

|

Country |

Tariff |

|

Cambodia |

49% |

|

China |

104% |

|

European Union |

20% |

|

India |

26% |

|

Indonesia |

32% |

|

Israel |

17% |

|

Japan |

24% |

|

Malaysia |

24% |

|

Switzerland |

31% |

|

Taiwan |

32% |

|

Thailand |

36% |

|

Vietnam |

46% |

Some goods won’t face reciprocal tariffs, meaning the tariffs that were imposed before will stay but additional tariffs won’t be added. This includes steel, aluminum, auto, auto parts, copper, pharmaceuticals, bullion, and more. You can view the previously placed tariffs on Canada, Mexico, and EU below:

| Country | Tariff |

| Canada |

25% tariffs on products unapproved by the USMCA 10% tariffs on energy products 10% tariffs on imported potash No tariffs on USMCA-qualifying goods |

| Mexico |

25% tariffs on products unapproved by the USMCA 10% tariffs on imported potash No tariffs on USMCA-qualifying goods |

|

EU |

25% tariff on steel and aluminium |

Tariffs on goods that are approved by the USMCA were delayed until April 2, 2025 but on that day Trump announced that they will remain non-tariffed.

Meanwhile, China was initially hit with 10% tariffs on their goods but it rose to 20% in early March. As of April 9th, Trump hit additional tariffs on China, reaching a staggering 104%.

The EU has faced threats from Trump to place a 200% tariff on EU wine and champagne. However, this didn’t happen. Instead, Trump placed a 20% tariff on all EU goods, which may result in more retaliatory tariffs from the EU.

How will tariffs affect your Shopify business?

Although Trump’s tariffs will present challenges to Shopify businesses that deal with international suppliers or manufacturers, they won’t be impossible to overcome. Yet, you have to be aware of what to expect to know what are the next steps you’ll have to take.

Here are the main ways how these tariffs can affect your business:

1. Increased product & shipping costs

If your business relies on international products, the cost of imported goods may get higher. This could affect profit margins unless you switch to US-based suppliers or negotiate better rates with your current suppliers.

For example, if you’re selling home goods, electronics, toys, or even automotive parts that you’ve imported from China to the US, your profit margin will quickly shrink. However, if you switch to US suppliers or manufacturers and negotiate better pricing, the margin won’t be as visible.

2. Shipping delays

Since tariffs are placed on multiple countries, customs officials and border enforcement agencies will have more work checking and approving each shipment. This includes closely inspecting the shipments and their documentation.

The process may take even longer when you classify products incorrectly or state the wrong country of origin. This could lead to more delays or even penalties, especially with products that cross more than one border.

You can avoid this using Shopify shipping apps that automate tax and duties and generate custom paperwork, like Easyship.

3. Potential order cancellations and returns

If you put the whole tariff price increase on the final price, it may increase order cancellations and returns. That’s especially if your store relies on competitive pricing and dropshipping.

Customers may even abandon their carts more often or cancel orders if shipping is delayed. That’s why it’s important to look into cheaper shipping couriers and negotiate better product rates.

4. Retaliatory tariffs

Some of the countries already responded to Trump’s tariffs with retaliatory tariffs. So, if your business exports to these nations, you should observe how it will affect your revenue. The same goes for businesses whose logistics include multiple nations, as it could result in multiple tariffs. As of March 27, these retaliatory tariffs against the US are in place:

| Country | Retaliatory tariffs |

| China | 15% tariff on coal and liquefied natural gas products.

10% on agricultural machinery, large-engine cars, and crude oil. 15% tariffs on wheat, corn, chicken, and cotton. 10% tariffs on sorghum, pork, beef, soybeans, seafood, fruit, vegetables, and dairy products. |

| Canada | 25% tariffs on products like wine, beer, coffee, appliances, apparel, footwear, and cosmetics. The full list can be found on the official Government of Canada website. |

The European Union (EU) announced that it will also impose retaliatory tariffs on US goods, such as home appliances, beef, poultry, bourbon, motorcycles, peanut butter, textiles, and aluminum. Meanwhile, according to AP News, Mexico is also preparing retaliatory tariffs but it’s not yet revealed what goods will be affected.

How can you decrease tariff impact?

To decrease tariff impact, Shopify owners will have to look into more local suppliers, maintain transparency with their customers, and find ways to optimize pricing. Let’s take a look at each method on how to decrease tariff impact in more detail.

1. Switch to US suppliers

As uncertainties with tariffs continue, American Shopify businesses may opt to switch to US suppliers. The good news is, US consumer behaviour may change together with tariffs. This means that many US consumers may also start choosing to support local businesses and avoid higher costs of foreign products.

This is a good chance for Shopify owners to look into domestic suppliers with similar price points. The initial investments may be higher but it will positively affect your business in the long run. You may even negotiate lower prices with suppliers to minimize the impact as much as possible.

Here are the main reasons to switch to US suppliers:

- Higher consumer trust. You may start adding trust badges to your product pages to show off that your products are made in the USA. According to a study by Business Wire, 79% of consumers say that they’d be more likely to buy American goods if tariffs impacted prices.

- Faster shipping. The faster you ship products, the more satisfied your customers will be. If you’re dropshipping or buying materials from US suppliers, the final product will reach the customer much faster than it would with foreign suppliers.

- Cost stability. When you’re importing products from China or other tariff-affected countries, you can’t be sure when tariffs will rise or go down. Switching to domestic suppliers ensures you can guarantee more stable pricing.

2. Diversify suppliers

If switching to domestic suppliers isn’t a good choice for your Shopify business, try to diversify your suppliers. That’s why it’s best to work with multiple suppliers that come from different countries to reduce the risk that tariff hikes will affect all of your products or materials.

Since Trump announced a 10% tariff for all countries as of April, you may want to prioritize countries that were least affected. Here are some countries that currently have the lowest tariffs for US imports:

- Israel – the country faces a 17% tariff.

- Philippines – a 17% tariff will come into effect.

- European Union – while there’s a 20% tariff, it’s one of the lowest ones available.

However, try to prioritize quality so you don’t compromise it in exchange for lower prices.

3. Optimize pricing strategy

Review how you could optimize your Shopify business pricing strategy so you wouldn’t pass the full extra tariff cost to your consumers.

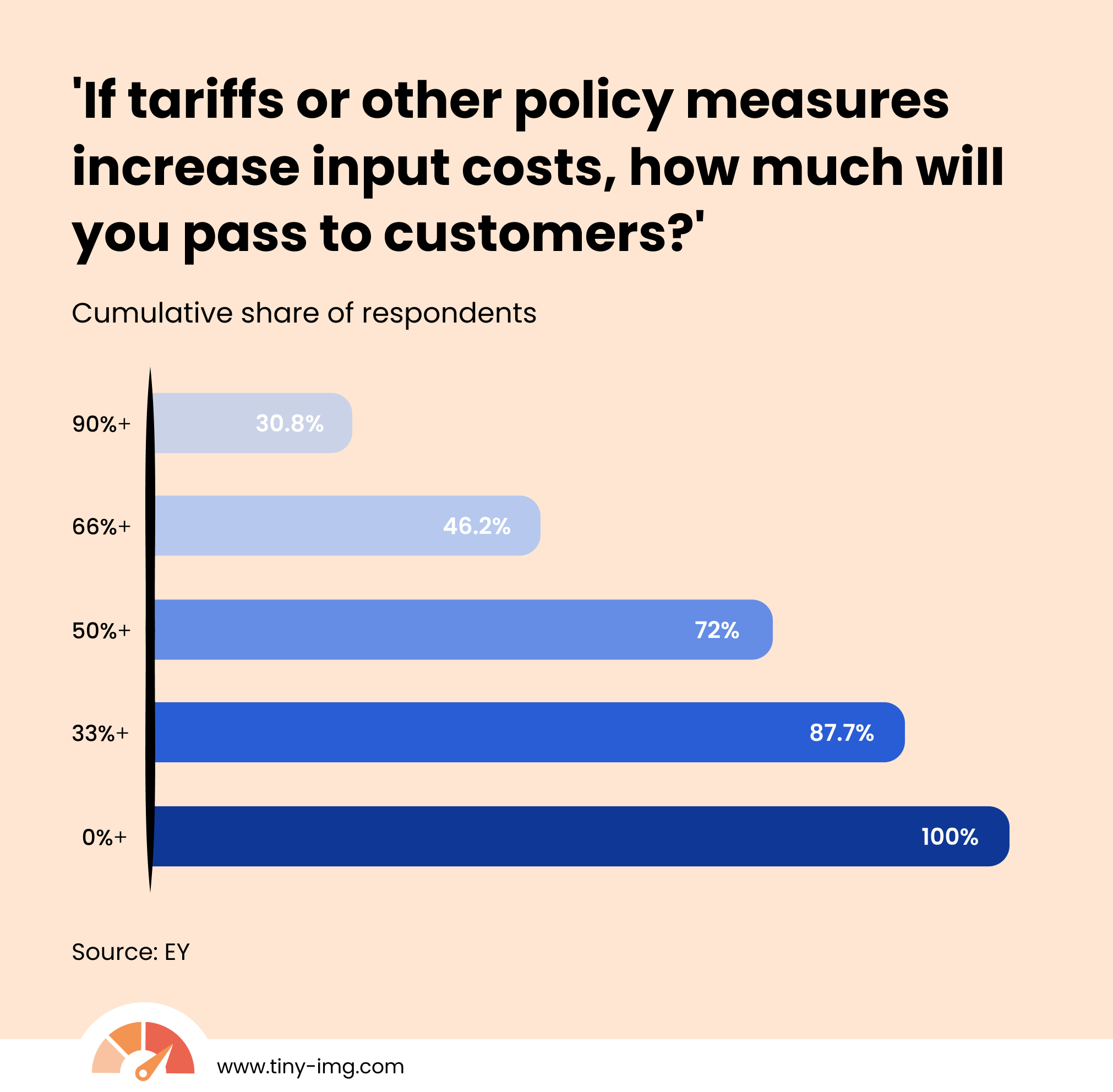

As reported by CNBC, a study by EY found that most (72%) executives plan to pass at least 50% of the cost caused by tariffs to their buyers. However, how it will affect sales will be visible further down the line.

So, you can optimize pricing by streamlining your strategy. Here are some tips on how to do it for your business:

- Negotiate better rates. Review your supplier agreements and try to request cost reductions. You may even ask for bulk order discounts or more flexible payment terms. Don’t be afraid to negotiate as many suppliers would rather decrease pricing than lose long-term clients.

- Optimize inventory management. Don’t hold excess inventory as it holds your capital. Meanwhile, running out of specific products can result in missed sales opportunities. Instead, try to manage your inventory more effectively using Shopify inventory apps.

- Look for cheaper shipping options. Shipping costs, especially on an international level, can quickly add up. So, it’s better to look into various shipping providers and switch to the ones that offer the most affordable rates. Yet, try to find a balance between affordability and delivery speed. You can try looking using the Easyship free shipping cost calculator.

4. Be transparent with consumers

To ensure you maintain consumer trust during visible price fluctuations due to tariffs, make sure you remain transparent. For example, show any tariff expenses during the checkout process so consumers know where the higher price comes from.

5. Focus on website optimization

With new Trump’s tariffs and rising prices, you can offset some negative tariff impacts with website optimization. One of the main areas you can address is Shopify SEO, which helps increase organic traffic and reach a bigger audience.

Although SEO doesn’t automatically guarantee better sales, combining it with best conversion and page speed optimization practices can help your business grow quicker. Here are some of the best Shopify SEO checklist tasks you should implement:

- Perform a keyword research to optimize your content

- Write keyword-optimized product descriptions focusing on benefits

- Optimize meta titles and meta descriptions for all of your pages to make them attractive for the user to click

- Compress images to improve your page load time and reduce bounce rates

- Set up JSON-LD to enable rich results and attract more clicks

- Create user-oriented content, providing expertise, statistics, and valuable insights

Most of these tasks can be automated with a single Shopify app called TinyIMG. It’s an all-in-one speed and SEO optimization tool that can help you stay competitive in the market even with Trump’s tariffs in place.

US-based supplier alternatives

When China-based companies like Aliexpress, Temu, and Alibaba are hit with tariffs, loads of businesses will start to look for local suppliers. Here are a few recommendations to help you get started:

- Faire.com – wholesale and bulk buying website for wellness, home decor, pets, baby, jewelry, and other types of goods. It instantly shows you the Manufacturer's Suggested Retail Price (MSRP), so you can plan what products are worth investing into.

- Dollardays.com – website with bulk and wholesale pricing for various types of products, including toys, personal care, electronics, groceries, and more.

- Wholesalecentral.com – free online wholesale directory that you can use to connect with wholesalers or manufacturers. There are endless product categories for dropshippers and even a “Made in the USA” section. You can instantly see the location of the supplier by the description.

- Spocket.co – a Shopify app with 80% US and EU suppliers. It offers plenty of categories ranging from beauty to electronics and faster (3-5 day) shipping.

Will Trump’s tariffs kill dropshipping?

While Trump’s tariffs will pose significant challenges to dropshippers, it won’t kill dropshipping as a business model. Rather, it will force website owners to adapt to changes.

The tariffs on China, EU, Canada, and other major trading partners may force dropshippers to turn to domestic suppliers to avoid import duties and even slimmer profit margins.

Additionally, the Trump administration is also planning to eliminate the de minimis exception, which is a minimum value of imported goods that is exempt from tariffs ($800 USD).

The end of de minimis would largely affect dropshippers with international suppliers because they rely on low shipping costs. Instead, if you run a dropshipping business, you can gain a competitive advantage by starting to hunt local suppliers or suppliers from countries with low to no tariffs and negotiating better rates.

If you’re a Shopify business owner, you can try looking into Shopify dropshipping apps. Some tools can help you find or manage country-specific suppliers or easily count shipping costs.

The future of eCommerce and tariffs

Global trade policies continue to evolve, and Shopify businesses must start implementing strategies to adapt to the shifting tariffs. Trump’s tariffs highlighted the vulnerability of some business models, like dropshipping, which rely on imported products from other countries, especially China.

However, Shopify store owners who stay informed and flexible, including diversifying suppliers, improving pricing strategies, and inventory management, will be the ones who adapt and succeed.

Tariffs may be adjusted with time, but they’re unlikely to disappear. With new tariffs on goods from all countries, it’s important that you already start planning adaptation strategies and building resilience.

Frequently asked questions

Trump believes that tariffs will boost US manufacturing, protecting jobs for the American people. This would raise tax revenue and grow the domestic economy.

Tariffs are likely to cause higher costs for consumers. While the price increase will depend on the tariff size and vary by business, consumers could see a 15-20% price hike on certain goods. This could include anything from groceries like meat, fruits, and vegetables to electronics, cars, and toys.

Yes, even if goods were shipped before tariffs took place but reached the US after the date, tariffs are likely going to apply.